In the everlasting search for the best and most profitable opportunities in the field of DeFi, I’m testing out different platforms. Before considering a platform to become part of my portfolio and put some bigger exposure to it, I first would like to see how the product and its mechanics actually work.

In this article I’ll cover a platform called MakeDeFiBetter aka MDB and in particular their MDB+ and Phoenix+ product propositions.

What is MakeDeFiBetter?

The best way to introduce the protocol is by using their own words:

MDB is an innovative and original DeFi token on the BSC network, utilizing our unique Capital Synergy mechanism to ensure long term, perpetual growth for holders.

A compound effect of tokenomics, deflationary nature and intelligent investment strategies power our Capital Synergy; ensuring a token that will increase in value over time.

This description is mainly focussed on their main coin $MDB. The value of this token is supported by investment activities and some unique burning mechanics.

In the broader ecosystem two additional native tokens are offered, which are $MDB+ and $Phoenix+.

On top of that the platform includes a DAPP which goes by the name Xenia and offers an insights dashboard showing the performance of the tokens, options for staking and farming and bonds.

Lets have a look at the different tokens.

MDB Token

The tokenomics for MDB can be found on the website. Most important to take note of is that the supply of tokens is depreciating and new tokens cannot be minted.

Taxes are 10% on buy and 15% on sell. Of which the bigger part goes into the Trust Fund supporting the treasuries behind the protocol and the smaller part is used for marketing and operations.

The chart for MDB can be found below (current state in the picture, link to live chart in the caption)

MDB+ Token

Following the introduction on the website regarding this token:

MDB+ is an additional token in the MDB Ecosystem

MDB+ is a stable-backed token offering guaranteed appreciation backed 100% by BUSD.

This is interesting. It’s not a stable coin but increasing in value over time. As a result of the mathematics applied in the smart contract, the value can only go up…! Really? Yes, really.

BUSD BACKED

MDB+ is 100 % backed by BUSD.

GUARANTEED APPRECIATION

The buys and sells of MDB+ have a small tax which results in the controlled, steady growth of liquidity.

If you’d look at the chart for this token you will see fluctuations to the upside and downside. The mean however is growing gradually. Trading volume determines the pace of which the token value increases.

In order to better understand how this works, you can have a look at this video. (NOTE: the calculation seems to have a flaw in it where it states 0.75% of 100K is $ 250, while it should of course be $ 750. But apart from that it explains the mechanics pretty clearly.)

Phoenix+ Token

Again using the explanation straight from the website:

PHOENIX+ is a twist on MDB+, offering the same guaranteed appreciation (the price cannot go down) but much higher APY.

How does it work?

Phoenix+ is essentially a more aggressive, gamified version of MDB+, offering the high rewards. The high APY is sustained by small taxes in and out that directly increase the BUSD backing of the token.

Why would you consider MDB+ if Phoenix+ returns a higher APY? The magic is in the word “Gamified”!

Phoenix+ as stated can never go down in value, again because of the built in mechanics. However, this product can buy out holders. As long as the demand and thus the volume for the token stays high enough and doesn’t flatten, everything is fine. But once the demand and trading volume dries up, the contract will interfere, buying out holders and charge an additional fee on the buyout. This fee is used to pump the token value again.

The moment this interference, which is called Inferno, happens cannot be determines with high confidence. You could try to guess it based on the numbers and volume and such. However, when all holders sell when the volume and demand dries up, it might lead to increased volume which pushes back the chance for the Inferno to be executed. Sounds like a game, doesn’t it?

Then there is another aspect which is important to realise. If you sell you Phoenix+ token yourself, you will receive $BUSD. While if the protocol buys you out, you will end up with $MDB+. This could be okay, or not depending on what your personal goals are of course.

In the video below these mechanics are explained by the team themselves.

So with this token you cannot just buy, leave it and check again next year. You might have been bailed out by the protocol already along the way.

Current numbers MDB+ and Phoenix+

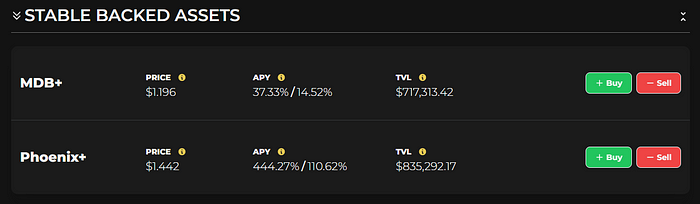

As said there is the XENIA Financial Suite DAPP showing price and performance insights for all the tokens of the ecosystem. In the below image you can see the current state for both MDB+ and Phoenix+.

This price values as displayed on the website are mathematically always going up. The value is represented in the contract details, while the price on some of the swap platforms like PancakeSwap may fluctuate and give people some arbitraging opportunities.

My strategy

As mentioned in the first section of this article, I’m looking for interesting DeFi opportunities to validate and consideration to add to my portfolio. MDB+ got my attention some time ago after which I noted it down on my watchlist. I was going to allocate some test amount to it as I always do to get experience with the protocol and to see how it works.

Now with the introduction of Phoenix+ and the possibility of being bailed out by the protocol into MDB+, I was thinking to risk it for some bigger gains. And that’s what I’m going to do.

So in short, I’d be happy to be invested in MDB+ but instead of buying it straight away and earning a 37% APY (at this moment) I will buy into Phoenix+ first. I’m not planning to try to outsmart the protocol and sell before the Inferno might happen, I’m going to put it in, leave it in as long as possible and wait until my share get bailed out by the protocol leaving me with my MDB+ share.

The risk for this approach is the potentially higher fees charged for my position. Up to a max of a 6% loss based on the tokenomics. That’s a risk I’m willing to take.

Wrapping up

In my opinion the MakeDeFiBetter platform offers an interesting proposition with all of their tokens. We have briefly discussed those and I shared my strategy dipping my toe in the water.

Phoenix+ here I come, don’t tell the Inferno, Please!

References

Website:

Telegram:

Twitter:

Discord: