Late October, just before the launch of The Animal Farm, I took a snapshot of all main metrics related to the DRIP Ecosystem and noted it all down in an article which you can find below.

The reason to do this was to be able to compare the impact of the launch of The Animal Farm on the broader ecosystem and its associated tokens. Now we are a little over one month in and it might be interesting to compare some numbers.

In this article the numbers of the snapshot taken on October 31, 2022 will be compared to the current numbers at the 9th of December. So you might want to open the previous article as well to be able to make a good comparison.

Note: I had to finish this article some days after taking the first snapshot. Therefore the snaphots are from:

- Total TVL and Pig Pen snapshots taken at 12–09–2022, ~14:00 CET.

- Other snapshots taken at 12–13–2022, ~20:00 CET.

The Animal Farm numbers

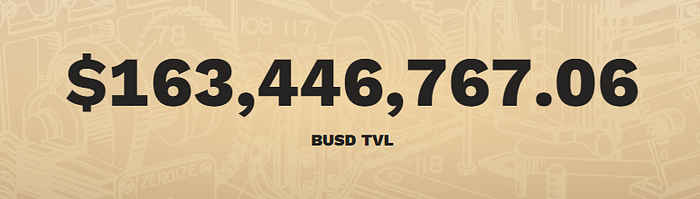

Total Value Locked (TVL)

The Total Value Locked for the Animal Farm at this moment:

Whereas the TVL in the previous snapshot only consisted of PIGS and PIGS/BUSD LP, it now also includes:

- Total staked DOGS tokens value

- Total staked DOGS/WBNB LP value

- Total staked Farms collatoral value

- Total staked Pools collatoral value

The total TVL increased since the launch:

- From ~46 Million to ~163 Million BUSD

- By ~117 Million

- By ~360%

Explanation and expectation

This comparison might be a little off since on day 1 the TVL already pumped hard because of all deposited stakes of the investors into the Farms and the Pools. As well as by the liquidity which was added to the new DOGS token. So in one month, with the next snapshot, we most probably won’t see similar numbers compared to today.

However, we do see a steady growth of the TVL every day. It was only days ago when we passed 160 Million and now we are over 163 Million already. So although we can’t expect another 360% next month but I do expect to see a higher number than today.

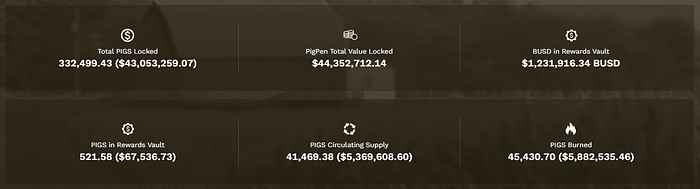

Pig Pen Numbers

In the below screenshot you find the current statistics for the Pig Pen product.

Lets compare and try to interpret each of the numbers.

Total PIGS Locked

332.499 PIGS are locked in the Pen compared to 293.912 PIGS in the previous snapshot. This product was already live when the previous snapshot was taken. With the launch of the Animal Farm, people were offered tools to earn additional Pigs by farming and staking. Since the main play of the platform is to grow your stake in the Pig Pen, it seems that people did move their PIGS into it.

PigPen Total Value Locked

At the moment ~$44.3 Million worth of PIGS is locked in the Pig Pen compared to ~$42.8 Million last month. So a little increase in total USD value. This is because of the lower token price appreciation at this moment compared to one month back. PIGS token price will be covered later on.

BUSD in Rewards Vault

Here we see a big difference. Although the mechanics are unchanged, the BUSD still pays out 3% of its balance to its stakers every day. The number is way higher than it was before. In the months prior to the launch the BUSD rewards vault got drained all the way down to 15k BUSD. Since there was no new inflow of funds, nor any injections done by the team and it kept paying out the 3%, 15K was only what was left.

The first day after launch of the Animal Farm the team did a 2 Million BUSD injection into the BUSD Vault. Later on another 500K BUSD was added to it. And now that all mechanics are at full throttle it vault collects taxes from several interaction with the contracts as well.

Current value of the BUSD Vault is at ~1.2 Million. In the past period of time we have seen the total value decreasing. The total only significantly increased as a result of the injections by the team.

On December 8th a new functionality was launched though which will host Governance Voting on proposals regarding next steps of the ecosystem. The first proposal which will be up for voting is about the frequency of injections. Details will follow.

PIGS in Rewards Vault

The number of PIGS in the Rewards Vault decreased from ~778 to ~521. These PIGS are collected from taxes on breaking AFP/BUSD LPs which are earned from the Piggy Bank. Not too many people (relatively) are invested in this product and it offers long lasting options before taking out earnings. Apparently the distributions to the Pig Pen holders outpace new inflow into the Vault which leads to a decrease in total PIGS left in that vault.

PIGS Circulating Supply

At the moment ~41.5K PIGS are circulating whereas we had ~64K circulating PIGS at the end of October. This means more PIGS were accumulated by investors and taking out of circulation by staking them in the Pig Pen or Piggy Bank.

This is a positive development. Especially when considering the Farms and Pools are generating more PIGS as their emissions as well, which increase s the total amount of PIGS.

PIGS Burned

~45K PIGS have been burned, compared to only ~5K at the moment of the previous snapshot. That’s an additional 40K PIGS out of circulation.

So looking back at the previous section, I think we can conclude that the Farms and Pools indeed did introduce a lot of new PIGS but as a result of the tokenomics and in particular this burn mechanism, in the end less PIGS are circulating now.

We all know the potential effect of supply shock, right? That would be very interesting with regards to the AFP token price.

*Fees and tokenomics for these interactions can be found on the wiki.

Expectation

Regarding these numbers, I think we can see the same effects being repeated for all of these categories. Since the Pig Pen was already live before the launch of the rest of the farm, the impact of the farm itself might not have been to big.

So BUSD Vault will pump on injections and decrease between injections. Burned PIGS will only go up, since once burned those cannot resurrect.

The TVL in USD value will mainly be determined by the token price. Of course the amount of the staked PIGS matter as well but the bigger the price fluctuation will be the lower the impact of the changes in Staked PIGS on the TVL value will be.

Piggy Bank

The following numbers are comparing the Piggy Bank one month ago with current situation. I’m still not in the Piggy Bank so I will only share the numbers for anyone interested to compare both.

Summary: Total number of PIGS went down, TVL went down as well.

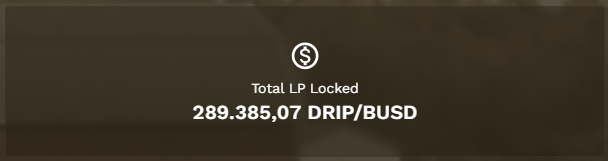

DRIP Garden

The DRIP Garden is a sort of a Miner game. The contract contains locked DRIP/BUSD LP.

The Total LP locked went down from ~400K to ~289K DRIP/BUSD over the course of 40+ days. Although we shared in the expactations the last time we thought the contract balance would go up again after launch, it clearly didn’t.

In the past we saw the contract balance decline towards a release since people were claiming rewards to enter the to be launced product. Afterwards the balance went up again. This time no increase happened so far.

Expectations

I expect the contract to decline further. Until DRIP price reverses upwards again. The reason why is because the garden reward per plant decreases over time, so only a positive price impact of the reward token would make it interesting to get involved again.

PIGS ($AFP) token value

The PIGS token is the governance token for the Animal Farm.

The governance token dumped pretty hard at the moment of launch after which it made a pretty steady bounce upward. Until las week when it suddenly started to bend and break down. Price per token is 31% lower than the day before launch.

Explanation and expectation

So what could be the reasons for this price action? The main driver for negative price action these days is of course the overall market condition and sentiment. One after the other debacle happens, FUD still seems to have huge impact on the markets.

Furthermore, looking at the utility of this specific token, people might have expected higher gains comoing from the main divident generating product for PIGS tokens the Pig Pen. If that is disappointing short term, people tend to decide to switch to other platforms which offer higher rewards, being sustainable or not does not alwasy matter for some.

Lastly, since the Dog Pound now is running and generating PIGS rewards, people might decide to sell their earned tokens for a direct gains instead of staking them in the Pig Pen.

In days from now the first governance vote will be published. The Pig Pen stakers can vote for the Pig Pen BUSD Vault Injection frequency. In other words how often earned CAKE by the protocol will be sold to BUSD in order to inject in the BUSD Vault. This will increase the Pig Pen daily payout again which might gain new interest for accumulating PIGS. This could be a turn around for the price of it.

DOGS ($AFD) Token

The DOGS token was launched along with the platform itself, therefore we cannot compare it to the the 31st of October. However, we can post the toekn chart to review the price development.

The first pump on the left in the chart was the liquidity being added on launch. After that we saw an increase of 27.5% to the top of the price at around 59 dollars. Now price pulled back a little again to a level of 55.8 dollar which is ~19% from launch price.

Because of the tokenomics and extremely high taxes on DOGS, only a few people sold some of their DOGS tokens. Some by accident, some just taking the loss of the high taxes. But in general, people are incentivesed to hold on and stake their DOGS tokens for as long as possible to decrease the taxes on a sell action. You can check out the official Wiki for more details.

Expectations

As briefly touched upon, the longer one stakes his DOGS tokens in the Dog Pound the lower the taxes on the DOGS token, in case of sending or selling it, will be. Therefore, I’m expecting more price fluctuation in the upcoming period since the people who started to stake from day one already collected 42% tax reduction.

Important note, this latest price dump was a result of the FUD regarding Binance and the effect of that on BNB price.

Forex Shark shared a post regarding this event, saying:

[..]Also don’t get shaken out by the moves of the overall market. BNB drops 13% in USD value due to ridiculous unfounded fud, since our native assets and the collateralized TVL on our platform have cross exposure to BNB, we saw a correction of our TVL and assets in their USD value but it was less of a correction than BNB did. So we continue to outperform the market but still you have some people who don’t understand cross exposure think that the correction was due to sales on our asset or withdrawals from our platform and they get shaken out. Don’t be on of these people‼️ — https://t.me/forexsharkcalls/1256

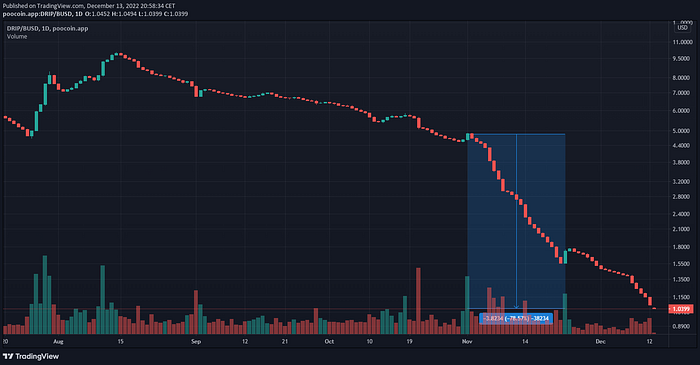

DRIP ($DRIP) token value

DRIP is the foundation of the ecosystem. Note: this is the price on PCS, whereas the native DEX will show a higher price because of tax differences.

I’m pretty sad my expectation as described in the first snapshot article became reality:

I’m not convinced about the big impact on the DRIP price to be honest. Being a DRIP investor myself, of course I hope it will make the token appreciate big time. But I wouldn’t dare to lay down a price prediction myself. Current price being the floor and any double digit price for 1 DRIP would be very very nice already in my opinion. — https://cryptozoa.com/lets-take-a-snapshot-of-animal-farm-and-drip-ecosystem-before-november-1st-long-awaited-launch-8d3fa10ca4aa

DRIP price kept on declining and doens’t seem to be done either by now. We hoped for a positive effect of the Farms, and especially the DRIP/BUSD Farm, going live, but it seems there is more needed to reverse its price development.

The reasoning was two-fold. First, the fact that people would be able to stake their DRIP which would give people another option than just sell DRIP was expected to decrease sell pressure drastically. Second, there was consensus among the community that people were taking out DRIP earnings to prepare for the Farms and Pools in the runup to the launch. However, both events happened and didn’t have the anticipated effect.

Expectations

There are two thoughts going around which arguing for a positive price impact. First there is the idea that people who got involved in the Animal Farm will rotate their earning back into DRIP once they collect their dividends. The second one being the announced improvements and extentions of the DRIP protocol itself. Things like Fiat on-ramp, new UI, second layer Reservoir, Scratchy tickets.

I’m not sure if and which of these will be the one which turns things around. However, we know that there are some things that need to be achieved to have a positive impact on price:

- Decline of circulating DRIP tokens; e.g. burns, buy backs, infinite lock ups

- Increased buy pressure over sell pressure

- No minting of new tokens

- Incentives to not sell any tokens

These kind of implications should be the result of any new initiative or enhancement in order to push reverse the price.

Furthermore a positive market sentiment in general and people making profits will make people rotate their capital and spread their investements into different protocols. DRIP could be one of those.

Wrapping up

We have discussed and compared several interesting metrics with the numbers of the day before the Animal Farm launch. To be honest, I personally hoped for more positive effects on the main metrics like the PIGS token price and DRIP. But like we see too often, the hype runs until the launch of a platform and fades afterwards. Especailly in these hard times in this field it takes very much positiveness to stand out from the general sentiment and market developments.

In a month we can compare again to see how we stand.

My referral

If you decide to invest in The Animal Farm yourself, after having done your own research, please consider using my referral link. It’s very much appreciated, thanks!

References

Website:

Wiki

Telegram channel The Animal Farm:

Telegram channel Forex Shark Calls: